In 2019, CABRI launched the Africa Debt Monitor, a unique platform for sharing information on African central government debt and debt-management policies, practices and institutional arrangements. The ADM was developed by CABRI in consultation with African debt management offices and provides the type of debt-related information that officials have expressed is a prerequisite for making informed decisions and promoting debt sustainability. The ADM also provides the basis for our ADM Analysis series where we provide deeper insight into cross-country challenges and trends in debt management across Africa.

In 2019, 20 African countries, voluntarily and without any incentive but a desire to improve debt transparency on the continent, completed the ADM survey. In our second iteration, three additional countries – Benin, Congo and Morocco – joined the ADM. The second iteration of the ADM data collection exercise began mid-2020, coinciding with the onset of the COVID-19 pandemic and strict lockdowns across many African countries. Given that many officials were working from home, the process of data collection presented many more challenges than in our first round. Officials often did not have access to the debt-recording and management systems (DRMS) from which much of the quantitative data in the ADM is extracted. We significantly extended the timeline for countries to complete the survey, however even with this extension, some countries which participated in 2019 were unable to provide data in 2020 and 2021. We hope that these countries will return for our third iteration and update the missing years’ information.

Between 2017 and 2019, we saw central government domestic debt increase by an average of 2% for those countries for whom data was provided. This average was however not representative as we saw some countries like Burkina Faso increase the value of its debt stock by 63%, while others such as Botswana, Cote d’Ivoire and Madagascar increase by a far more modest 1-6%. Nigeria was a significant outlier, decreasing its domestic debt by 52%. For central government external debt, the average increase was significantly higher at 10% however, there are similarly large deviations between countries. Botswana, Mauritius and Nigeria registered respective decreases of 16%, 20% and 33%, while Cote d’Ivoire and Uganda observed a similarly large increase (36% for Cote d’Ivoire and 40% for Uganda). It is noteworthy that these average increases in domestic and external central government were before the pandemic struck. Many governments borrowed heavily to fund their COVID-19 response efforts and counteract revenue contractions. It will be instructive to see how these trends shift in our next round of data collection.

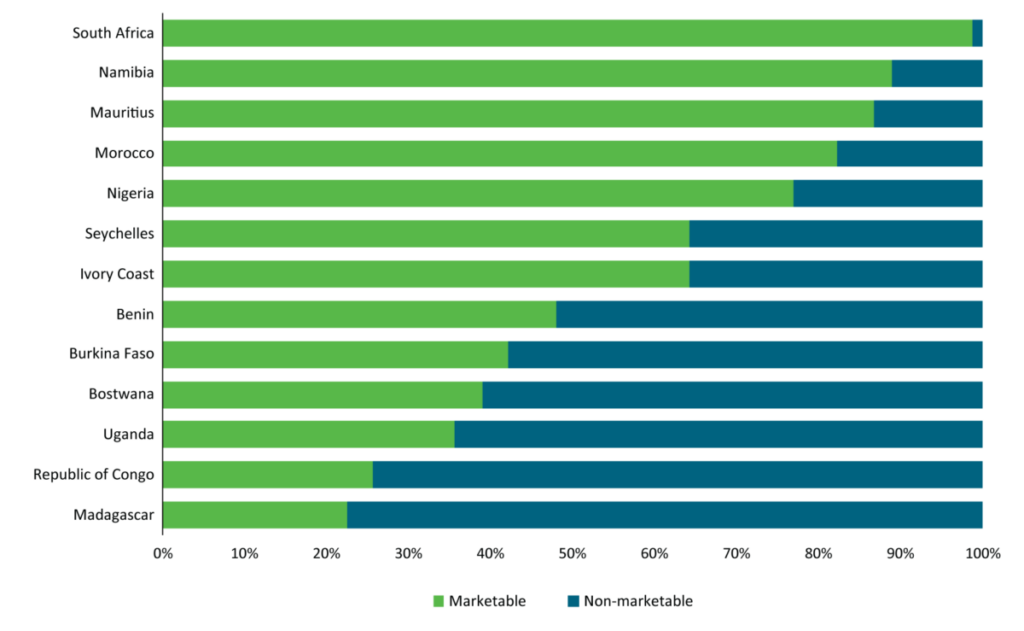

We also observe a shift towards market-based domestic and foreign debt, with a decrease in the share of multilateral and bilateral non-marketable debt in central government stocks. As discussed in the ADM Analysis report, Managing risks of ever-changing debt portfolios in ADM participating countries, this changing market risk exposure necessitates effective and active risk management. It also reiterates that multilateral debt relief efforts were insufficient during COVID-19; negotiations with commercial lenders would have been required if relief was really to be felt.

Marketable and non-marketable central government debt in 2019

Source: ADM surveys

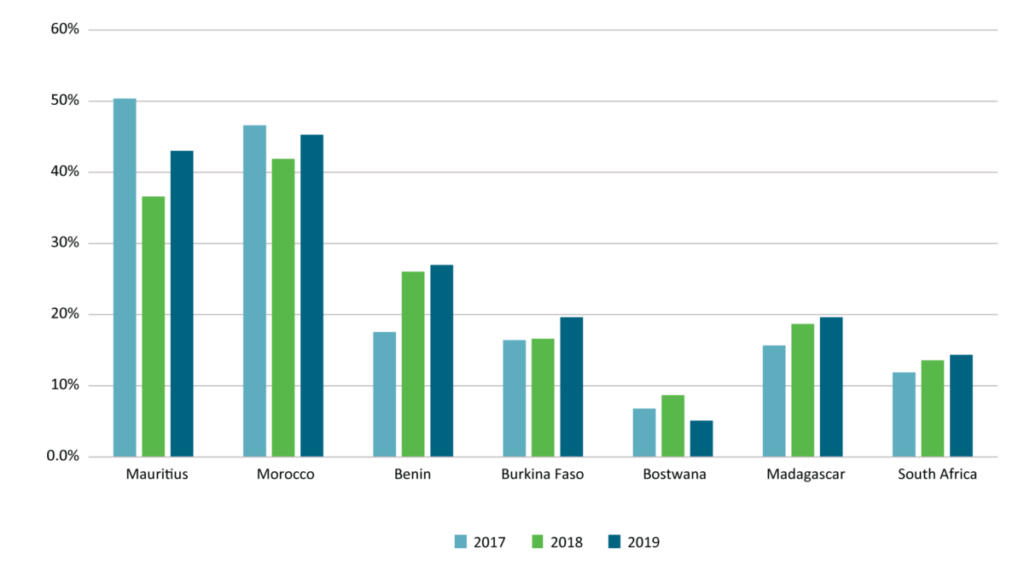

We also see that another source of risk, increasing debt-service costs, pose not only a threat to debt sustainability, but also threaten to further crowd out priority social spending in government budgets. As seen in the figure below, in a sample of ADM countries, only Botswana did not see increasing debt-service costs as a proportion of recurrent revenues between 2017 and 2019.

Debt service costs (total debt service/recurrent revenue)

Source: ADM surveys. Data covers medium- and long-term debt service only

The second report in our ADM Analysis series for 2022, The state of debt transparency and accountability in Africa: Insights from the Africa Debt Monitor, highlights the importance of debt transparency. At the global level, a lack of transparency obscures the true extent of rising debt levels and associated debt vulnerabilities, potentially delaying the identification of debt crises, worsening the situation and making its eventual resolution more complicated and lengthier. At the national level, the sudden discovery of a large amount of previously unaccounted debt, or financial liabilities that can translate into debt, can itself trigger a debt crisis with substantial economic and social costs for the country concerned while also inflicting severe reputational damage.

This report illustrates that debt data quality, a core aspect of debt transparency and accountability, is inadequate in most African countries. Only 10 of the 23 ADM countries stated that all government debt is recorded in their DRMS. In many countries some debt categories, including domestic debt, guarantees (e.g. to state-owned enterprises) and derivatives, are still managed outside the DRMS. HR capacity also limits information sharing within government and undermines transparency efforts. While nearly all ADM countries have adopted the recommended three-tier structure of having a front, middle and back office, these are often understaffed. Capability gaps also exist, and officials do not always have the necessary skill to extract data from the DRMS, again inhibiting transparency efforts. Finally, the report shows that although a large percentage of ADM countries (91.3 percent) are subject to external audit exercises, a much smaller percentage (65.2 percent) publish the findings. It is also unclear how many countries act on the recommendations of the audit reports. We conclude that the achievement of debt transparency and accountability in the 23 ADM countries is very much a work in progress.

The next round of ADM data collection will commence in the last quarter of 2022. It is with bated breath that we wait to see the extent to which the COVID-19 pandemic has pushed debt levels further towards the dreaded unsustainable territories.